Introduction

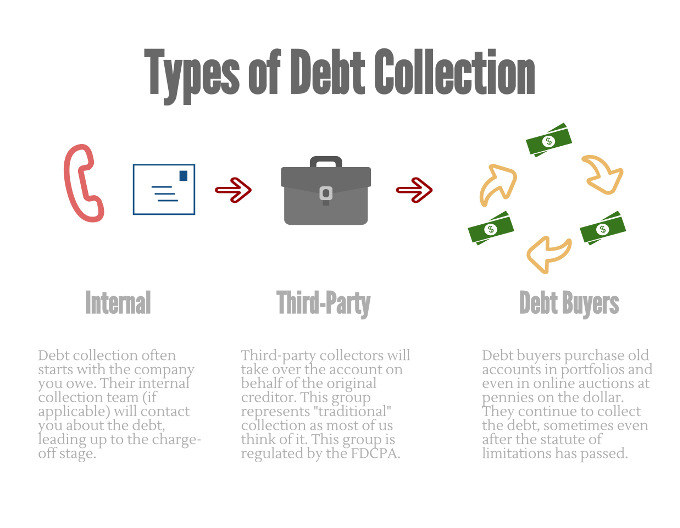

Lenders utilise debt collection agencies and debt purchasing companies to remove bad debts and written-off debts from their balance sheets and the assets section. Companies known as "debt buyers" will pay a company a fraction of the total amount owed on delinquent accounts in exchange for taking over collection efforts on the accounts. Taking legal action against a debtor to compel payment of a financial obligation constitutes debt collection. Most consumers borrow money from a financial institution and then make regular repayments. If you cannot make your payments on time, your connection with that lender may be jeopardised. Companies typically detail the circumstances in which continuing to pursue a delinquent bill is preferable to release it to a debt collector. Here is where debt buyers and collectors step in.

The Roles of Debt Buyers vs Debt Collectors

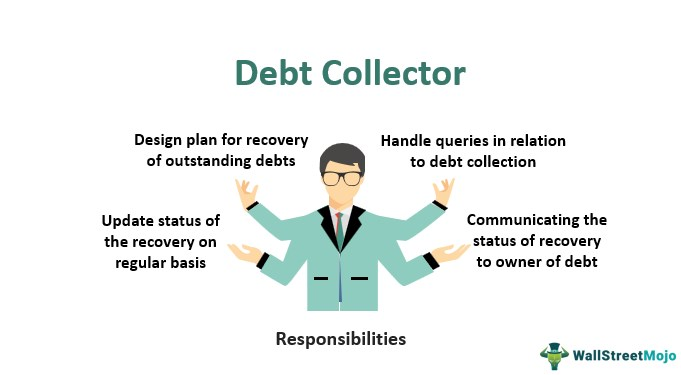

Debt collectors are a common institution that most people are aware of. Debt collectors are the people that repeatedly contact to get money owed to a creditor or other business. On the other side, debt buyers are organisations that acquire bad debts from other firms to recoup those losses. Debt buyers may also perform debt collection services for the accounts they have purchased from other businesses, or they may transfer or sell the accounts to another collection agency. There is not much you can do once a creditor has sold your debt to a debt buyer. After that, communicating with the original lender or creditor will be impossible, and only the debt collector will be able to help you.

Paying Pennies for Your Debt

Debt purchasers typically offer very low prices for delinquent accounts. They only offer a fraction of what is owed, especially for older debts. Because it is less likely that an older debt will be paid, the price at which it is sold decreases as its age increases. For instance, a debt purchaser may offer $50 for a $1,000 debt. When the debt is settled, the debt buyer will pocket $950 in profit. Debt purchasers may acquire a large portfolio of defaulted debts, expanding their profit potential. The low price at which these delinquent debts can be purchased ensures that debt buyers will profit even if only a small percentage of consumers pay the debts.

Impact on Your Credit

Purchasers of delinquent debt are permitted to record purchase defaults as collection accounts to any or all of the three major credit reporting agencies. Equifax, TransUnion, and Experian are the big 3 credit reporting companies. 3 If a negative item appears on your credit report, it will be there for as long as the credit bureau maintains that information. Once the collection account is included on your credit report, your credit score will likely decrease. The debt buyer will not erase the account from your credit record after payment has been made. Payment status will be updated on the credit report upon successful payment. Your credit rating can rise if you make all your other payments on schedule.

Tax Liability on Canceled Debts

Taxes must be paid on the amount of debt forgiven as part of a settlement with a debt collector or debt buyer—cancellation of debt results in a taxable event for the amount written off. The creditor will report this amount to the IRS on Form 1099-C. Foreclosure and repossession can result in debt cancellation, discharge, or forgiveness. This still applies if some of the debt is forgiven and the property is surrendered to the lender or abandoned. However, this tax obligation may be avoided with some student loans.

How to Tell if a Debt Has Been Sold

There is no legal requirement for creditors to notify debtors when their debt has been sold. You might not know that your debt to a creditor has been sold until you hear from the debt buyer. However, before making any payments, you should inquire as to the legitimacy of the debt from the debt buyer or collector. You are within your legal rights to demand proof that the debt is owed to them before they can attempt collection. As a result, credit reporting agencies cannot use this debt against you.

Conclusion

Like debt collectors try to get paid by consumers who are late on their payments, debt buyers do the same. In contrast to debt collection agencies, debt buyers are the rightful owners of the debts they attempt to collect. The goal of getting a debt consolidation loan is to reduce the total interest you pay each month by consolidating your credit card balances into one manageable monthly payment. Debt incurred using credit cards differs greatly from debt incurred via personal loans. Revolving debt, such as credit card debt, differs from the instalment debt carried on personal loans.